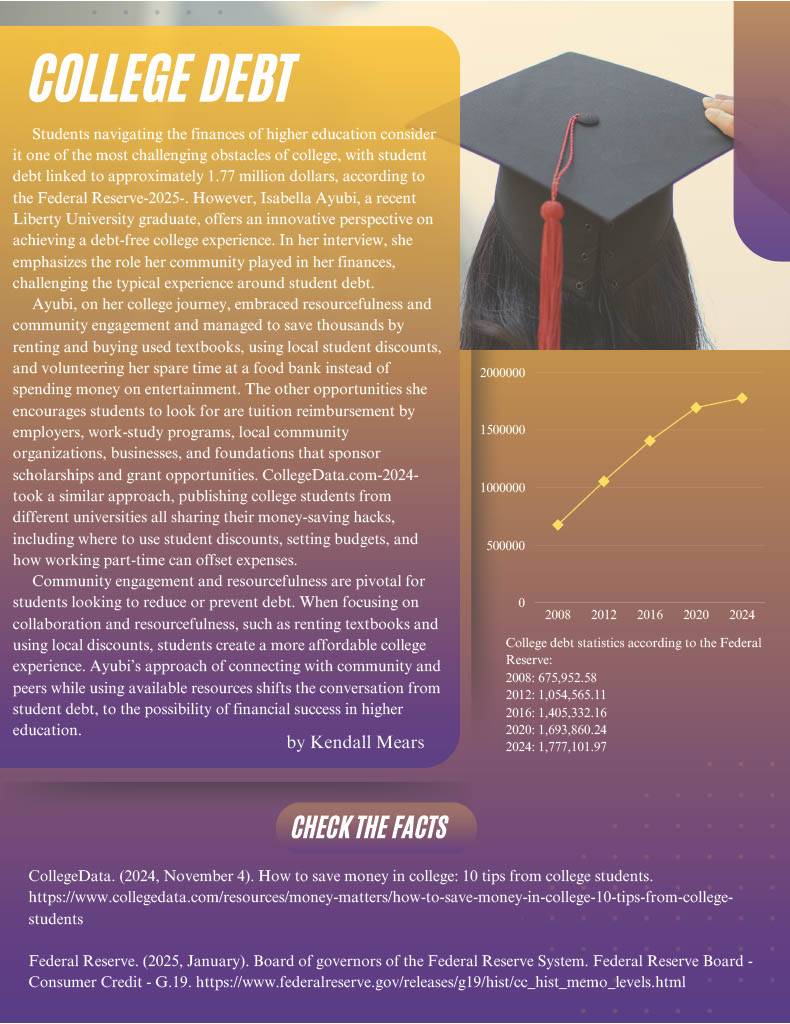

Students navigating the finances of higher education consider it one of the most challenging obstacles of college, with student debt linked to approximately 1.77 million dollars, according to the Federal Reserve. However, Isabella Ayubi, a recent Liberty University graduate, offers an innovative perspective on achieving a debt-free college experience. In her interview, she emphasizes the role her community played in her finances, challenging the typical experience around student debt. Ayubi, on her college journey, embraced resourcefulness and community engagement and managed to save thousands by renting and buying used textbooks, using local student discounts, and volunteering her spare time at a food bank instead of spending money on entertainment. The other opportunities she encourages students to look for are tuition reimbursement by employers, work-study programs, local community organizations, businesses, and foundations that sponsor scholarships and grant opportunities.

CollegeData.com took a similar approach, publishing college students from different universities all sharing their money-saving hacks, including where to use student discounts, setting budgets, and how working part-time can offset expenses. Community engagement and resourcefulness are pivotal for students looking to reduce or prevent debt. When focusing on collaboration and resourcefulness, such as renting textbooks and using local discounts, students create a more affordable college experience. Ayubi’s approach of connecting with community and peers while using available resources shifts the conversation from student debt, to the possibility of financial success in higher education.

- Kendall Mears, Published on 2025-02-12